How bad, you might be asking yourself, will the economy get? We’re about to find out.

Before we find out, bear in mind that a total economic collapse is probably the best-case scenario for humanity. Also understand that economic collapse is the least likely scenario.

Now for the bad news.

I read a recent post from Ben Hunt, co-founder of Epsilon Theory and one of the smartest people you can imagine. The post, Hollow Men, Hollow Markets, Hollow World tells the story of the mess we’re in and offers some advice—moral advice—on what to do about it.

Moral advice from a economist?

Yes.

Because . . . well, because the mess we’re leaves us only moral choices. Strategy won’t safe us. Financial jiggering won’t save us. Witty words won’t, either. Nor will the next election or the one after that.

As a nation and an economy there are two choices according to Dr. Hunt:

Kick the can down the road by nationalizing industries, forcing compliance, becoming a surveillance-police state.

Total economic collapse.

Option 1 will eventually lead to option 2, but it could take a couple of generations. (That’s my conclusion, not Dr. Hunt’s.)

Why the dark choices?

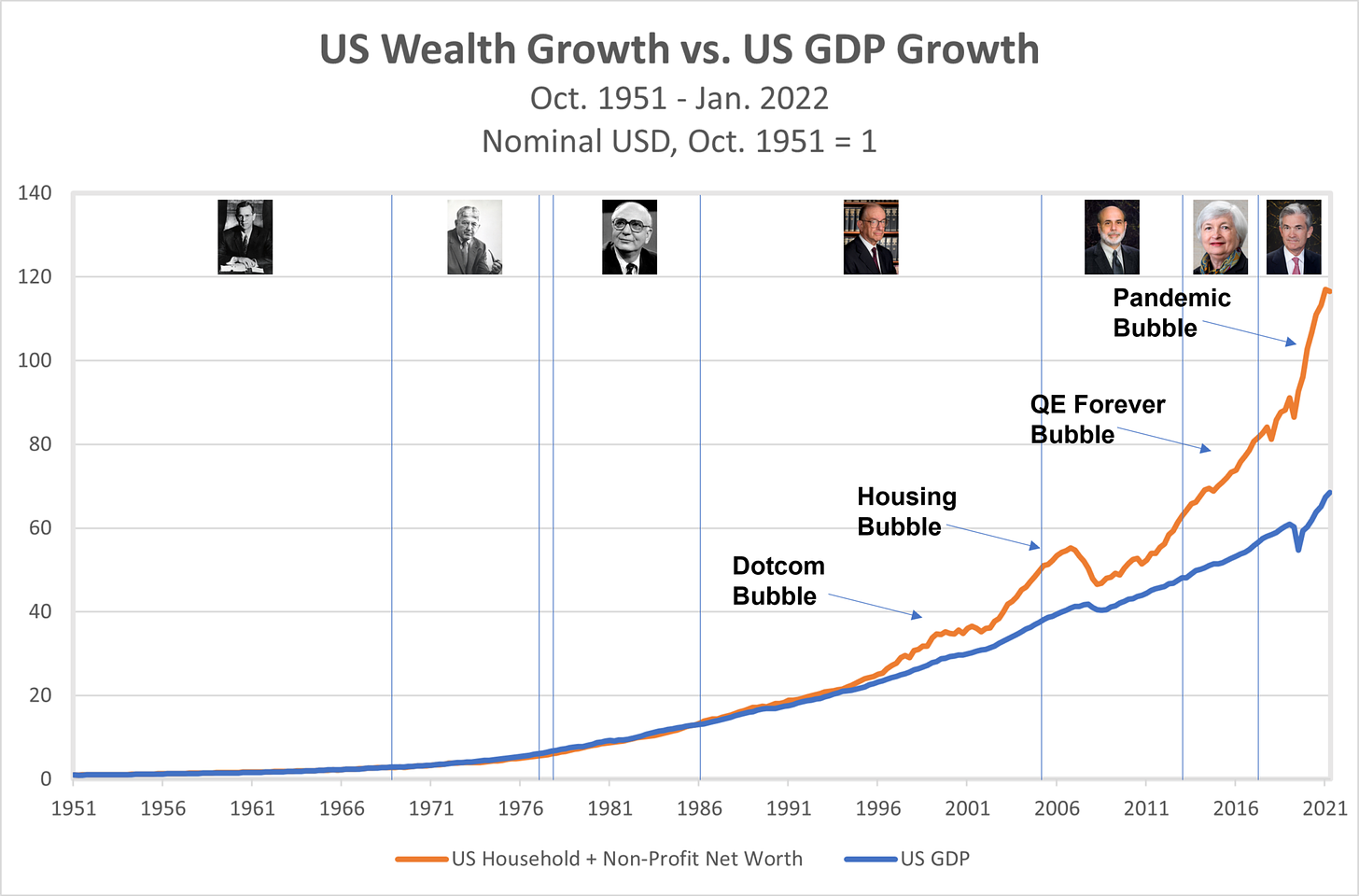

This chart:

The orange line is US wealth. The blue line is US GDP. The gap is the amount of wealth American households and non-profits must surrender. You see, these two lines must move in lockstep. They do over time. When they get out of sync, something will put them back into sync.

The gap is debt.

Accounts must be settled. It’s called “a reckoning.” And the reckoning is here knocking on the door.

To put this gap into historical perspective, here’s an extended view of the same data with Dr. Hunt’s markups.

From 1951 to about 1997—the year the Monica Lewinsky story broke and Howe and Strauss published The Fourth Turning—the two lines moved in lockstep. Then Alan Greenspan decided to tinker, to grow wealth without growing GDP and without kicking off inflation.

I won’t go into all the detail of how we got here, because Dr. Hunt does that brilliantly in the post on Epsilon Theory. I exhort you to read it after you finish this post. I give a free link that won’t cost you a thing.

What that gap represents is one of two things:

Money stolen from other people (other economies).

Money stolen from future generations of Americans.

How We Borrow from the Future

A few years ago, in the 1990s, we heard a lot of stories parents going to jail for identify theft perpetrated against their own children. About 1990, the government required babies to have a Social Security Number before they left the hospital. (I remember because it happened between our second and third children.)

Some shiftless parents soon realized they could apply for credit using their kids’ SSNs. They could default, and the creditor could do nothing. You can’t collect from a six-week-old infant.

This, of course, constituted credit fraud, so the parents who did this (and there were many) went to jail. (Not sure what happened to their kids who were left with no parents and lousy FICO score, but that’s not the point.)

The point is, all of us have been doing what those parents do only legally. The government allows us to run up our kids’ and grand kids’ debt as long as we do it with the government’s approved identity-theft programs.

So we did.

If you look at that chart, about 1/3 of our household and non-profit wealth is stolen from other generations or other countries. And we have to pay it back. Now. Or soon. But those future generations and other countries ain’t picking up this bill. We are.

The foreclosure process is underway.

How We Borrow from the World

Some months ago, I wrote a series of posts about the US dollar (USD) as the world’s reserve currency and the petrodollar. (Here and here.) To summarize, almost all international debt is settled with USD regardless of the two local currencies involved. Britain settles its debts with Costa Rica in USD, etc. This includes the oil markets. Saudi Arabia, in turn, buys US treasuries (national debt) as a store of value for its copious oil profits. This allows the US run up massive debt knowing there’s always a market for our bonds.

Until there’s not.

Have you notice that Saudi Arbia is drifting out of the US orbit?

I wrote it about in those earlier posts, but the most certain sign of the Kingdom’s pending divorce with from Uncle Sam happened this week. Saudi Arabia disclosed that Joe Biden tried to strong-arm the Saudis into delaying OPEC+ oil production cuts until after the November elections. In diplomatic worlds, this was a slap in the face insult to the US and, particularly, to the Biden regime.

Rumors say Biden threatened to cut military sales to the Saudis if the OPEC+ cuts were announced before the elections. Not only did OPEC+ announce the cuts on its timetable, the Kingdom told the world about Biden’s threat (without disclosing the exact terms or names). Among “partners,” such public humiliation is a sign of pending breakup.

In return, the State Department and Joe Biden announced they would reevaluate the US’s strategic arrangements with Saudi Arabia after the election. That should be interesting.

What it means is that the US might not have as eager a buyer for debt as we’ve grown accustomed to. And that means the price of US treasuries will decline. Less demand means lower prices. When the price of bond goes down, the interest goes up.

In the simplest terms, it’s like giving someone a check post-date to next Friday for $100 in exchange for $90 cash. You get the cash you need today, and they get their $90 plus $10 interest next Friday. That’s a simplified bond transaction.

Now, if you’re really bad with money, you’ll have to go back to this person a few days later and repeat the same process: a $100 post-dated check for $90 cash today.

That’s how the US has funded its ever-growing debt, and the Saudis have been a major buyer of that debt.

The US is making those deals with way more people than just the Saudis. From US citizens to Wall Street to big corporations to every country on the planet, the US is writing post-dated checks in exchange for cash, commodities, and all sorts of collateral. As long as there’s an ever-growing market for our post-dated checks, the checks all clear the bank, and we can write even more checks.

What’s more, the US can’t actually cover all the outstanding checks its issued. We have to write a $100 post-dated check to China on Thursday so the check we gave the Saudi’s last Friday clears the bank tomorrow. Then, we need to write one to Blackrock next Wednesday so the China check clears next Thursday.

You get the picture.

How the World Settles Accounts

But what happens if the third Friday after today the Saudis say they don’t want to give us $90 today for a check post-dated to next Friday? And what if we need that $90 from the Saudis to cover the check Japan’s going to cash on that Thursday?

Now, the US has to find someone else to take a post-dated check. Brazil says they’ll do it, not for $90 but for $75. That’s enough to cover China’s check, so we take it.

See what happened? The gross interest went from about 10% to about 25% in an instant.

But we’re not out of the woods yet. The Saudis also hold some checks that were post-dated for 10 years, 30 years, and more. We have to start writing a lot of $100 checks for $75 cash.

Soon, word gets around that we’re offering bigger discounts to Brazil, so the rest of the world want’s that discount, too.

Eventually, those checks will bounce.

I’m not saying the Saudis are about to stop taking our checks—I’m saying the for the first time since the Nixon administration, they’re acting like they might. Which means the are going to demand a bigger discount—the difference between the face value of the bond and sale price. That discount is the interest, and the bigger the discount, the less cash we have to spend tomorrow.

That’s one way to close that gap. You reduce the amount of cash you get in return for a future promise to pay. The amount you owe stays the same, but the amount you get now gets smaller.

How Our Kids Get Their Money Back

Remember the two ways we built that gap between wealth and GDP? That’s the first way. The holder of US treasuries want to cash their bonds, and they don’t want to buy new ones.

The gap begins to shrink, and that shrinking is mostly in household wealth.

The second way is intergenerational theft. So how do our kids and grandkids force their accounts settled?

Have you heard about the labor participation rate? Have you heard about the labor shortage?

An odd thing about the jobs numbers in recent months. While the number of “new jobs,” also known as “new hires,” has been strong, the number of people working has been going down, down, down. Why is that?

Well, according to several analysts, the number of people holding two or more jobs is going up, up, up. What’s more, the people holding two or more full-time jobs are typically over 45 years old. Via Schiff Gold:

An even bigger signal of the challenging economy is the number of people who have multiple full-time jobs. These are individuals who are working 80 hours a week at two different jobs to make ends meet. This figure has reached 440k workers, which is an all-time high!

Get it now?

The kids aren’t taking our post-dated checks, either. They’re simply not participating in the US economy—at least, not in the official US economy. They siphoning of that excess household wealth NOW, in the present. They are not working in ways that grows the blue line (GDP). They’re shrinking the gap by lowering the orange line (wealth).

Wonder where inflation is coming from? We’re spending the excess household wealth without increasing the products and services available to buy with it. Inflation is how future generations close that gap. They spend your excess wealth without producing. And it’s happening right before our eyes.

How Poor Will We Be?

As individuals, who knows. Economic shake-outs are uneven and unfair. People who, as Bill Clinton said, work hard and play by rules could end up homeless while slackers strike it rich. (There were millionaires made during the Great Depression.)

Moreover, black market and illegal activity will increase as the financial world crashes down. There will be far less money available for enforcement because we will be too busy just keeping systems and people alive.

From a macro level, we will end up as rich as we deserve to be. In other words, when all is said and done, our wealth will equal our productivity. The orange and blue lines will meld into one. Morally, justice will be done to the society as a whole. Our standard of living will decline, in aggregate, by 1/3, though, so we will feel robbed of something. We will be driving older cars, living in older homes, and eating simpler food. We will have fewer streaming services, fewer vacations, and fewer pairs of shoes we never wear. Will make more things ourselves, grow more food, and produce less trash.

In truth, we will only lose our ill-gotten gains.

While, we didn’t personally rob from the kids and foreigners, we were participants in a rigged game—a game that’s getting unrigged in a hurry. We enjoyed the spoils of the petrodollar and zero interest rates.

This account-settling process is called a reckoning, which sound harsh because it is.

What Can We Do Now?

Pray.

Stop spending and pray.

Start living like you just lost 1/3 of your assets and 1/3 of your income.

Use the spare time to pray, connect with friends and family, and build a network.

That’s been my advice for years, and I was happy to see it’s Dr. Hunt’s advice today:

how about we live as autonomous human beings possessed of a soul and a conscience? We find our pack – online and offline, networked and meatworked – other autonomous human beings who treat us as ends in ourselves, never as a means, and demand the same human treatment in return. (button below)

It’s all we’ve got, folks, and it’s all we ever needed: God, family, and whatever remains of country.

You might also enjoy this post from April. I referenced it earlier, but it sort of predicted what’s going on right now with inflation and the Saudi dust up.

Finally, this posted to Zero Hedge while I was finishing this post:

US-Saudi Relationship 'Likely Unrecoverable': Expert

The head of the American Enterprise Institute says US-Saudi relations are "likely unrecoverable," after the White House 'personalized' last week's OPEC+ decision to cut production, according to an expert cited by Bloomberg.

Saudi Arabia said the cuts were an attempt to ease market volatility, and lectured that relations with the US must be built on trust. A White House statement on Thursday sneered at Saudi Arabia’s attempt to “spin or deflect,” and Secretary of State Antony Blinken echoed Biden’s warnings that the decision would have “consequences.”

The remarkably public contretemps reflects brewing impatience within the White House now that it has little to show for Biden’s outreach to the Saudis -- which he was compelled to make as gasoline prices soared over the summer, despite his campaign promise to treat Crown Prince Mohammed bin Salman as a “pariah.” -Bloomberg

The unwinding of the petrodollar did not begin with the OPEC+ product cut, but that event—and the US reaction—have likely accelerated Saudi Arabia’s realignment away from the US. Security is still a major issue for the Kingdom, which has lots of enemies in the Middle East, but don’t be surprised if the Saudis propose a shift to direct payment with oil rather than settlement via the USD. After all, Biden has a big hole to fill in the US Strategic Reserve, and, at $90+ bbl, that ain’t gonna be cheap. Neither is the interest on the debt.